Expert view|General|AI

Are AI Influencers the New Face of Social Media Scams?

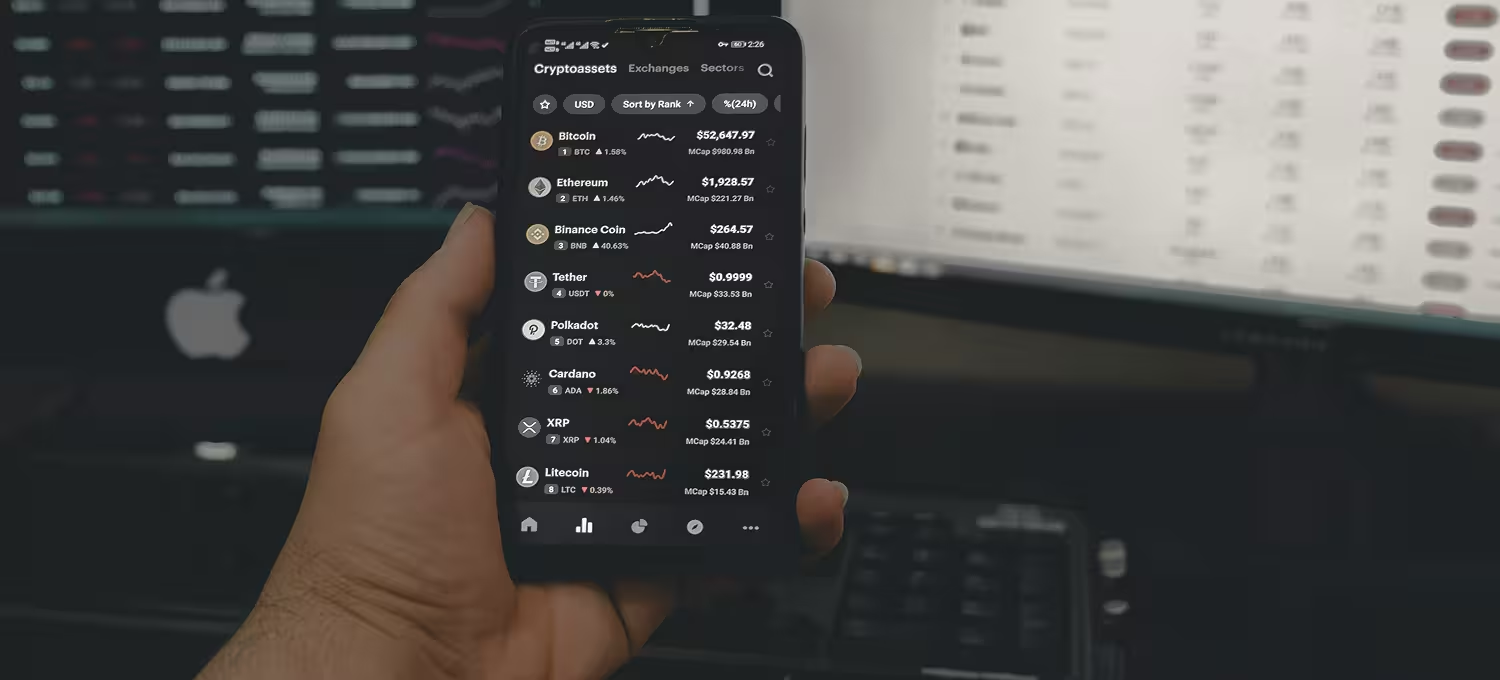

AI influencers can look real, sound credible, and build trust at scale. But are they actually being used for scams—or is the risk overstated? Megan Squire breaks down the documented cases, emerging patterns, and what the evidence shows so far.

)

)

)

)

)