F-Secure Scam Intelligence & Impacts Report 2025

Behind every scam is a human cost. This year’s online scam report reveals how fraud has evolved into a psychological, social, and systemic weapon—reshaping trust among consumers, service providers, and the digital systems that connect them.

Key Findings

F-Secure global insights and fraud data analysis reveal a disconnect: most people trust their ability to spot scams—yet nearly half still fell victim. Overconfidence leaves consumers exposed, and stigma leaves many too ashamed to speak out, making scams among the most underreported crimes today.

Key Findings 1 of 5

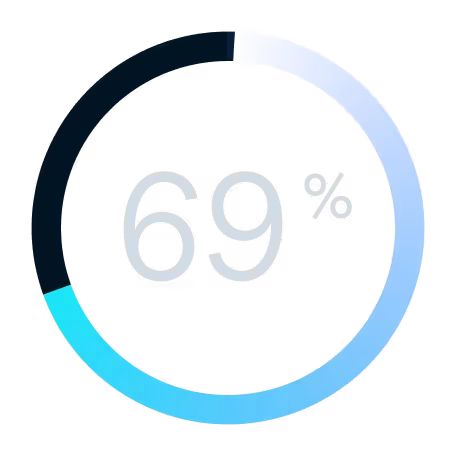

Confidence ≠ Resilience

69% of people believe they can spot a scam—but 43% of those individuals still fell victim in the past year.

F-Secure Consumer Market Survey, January 2025

Key Findings 2 of 5

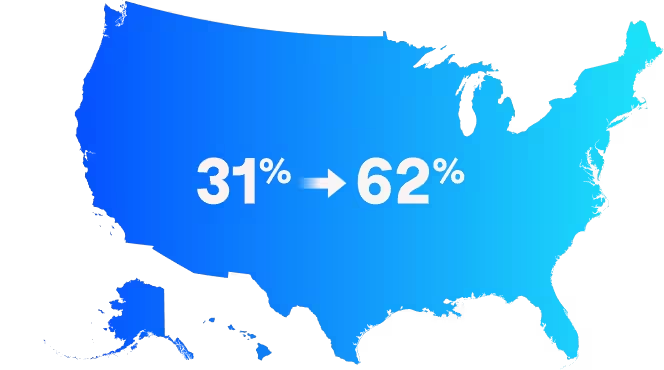

Victimization is Rising

Scam rates doubled in the USA from 2024 to 2025. In Vietnam, 90% of respondents were scammed last year.

F-Secure Consumer Market Survey, January 2025

Key Findings 3 of 5

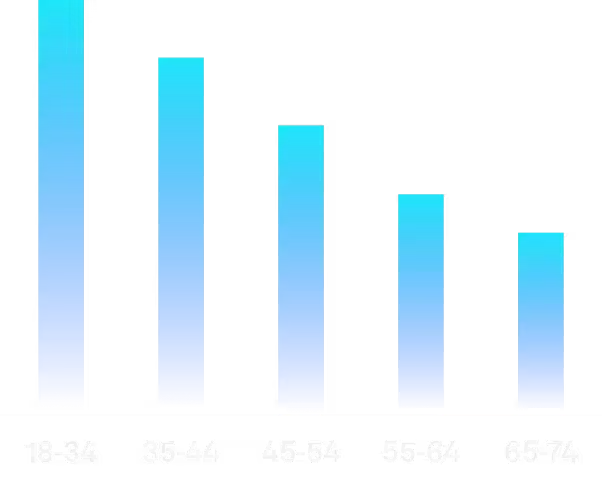

Young Adults Are Most Exposed

Individuals aged 18–34 face more than double the scam risk of adults aged 65–74.

F-Secure Consumer Market Survey, January 2025

Key Findings 4 of 5

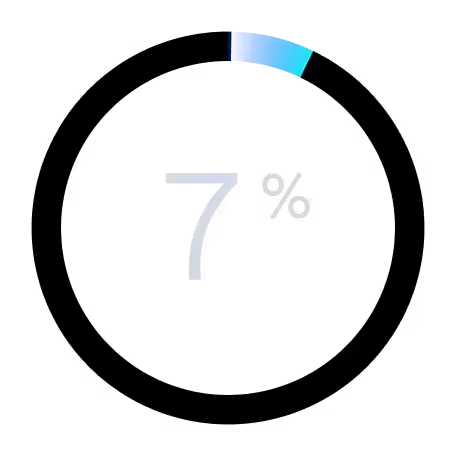

Underreporting is Widespread

Only 7% of scams are reported globally, largely due to victim blaming and feelings of shame.

GASA analysis of multiple data sources, 2024

Key Findings 5 of 5

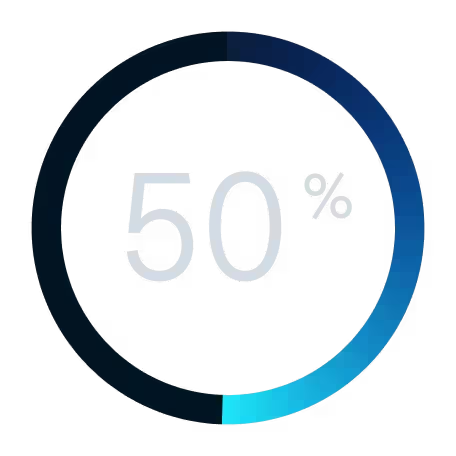

Consumers Want Protection

50% are willing to pay for scam protection—especially younger adults who expect it from service providers.

F-Secure Consumer Market Survey, January 2025

What’s in the Report?

What’s in the Report?

The F‑Secure Scam Intelligence & Impacts Report 2025 examines how misplaced confidence makes consumers vulnerable to threats such as fake emails, phishing attacks, and text message scams. Drawing on the latest consumer data and firsthand victim accounts, it reveals the true scale of scams and shows how cyber criminals exploit trust through AI scams and artificial intelligence fraud—highlighting the urgent need for stronger cyber security education.

The report also investigates the global machinery driving today’s online fraud, from deepfake scams and cryptocurrency fraud to the operations inside international scam centers. Through data and fraud analysis, it shows how scammers combine technology and psychology to scale deception. These insights reveal how cyber offences are evolving into complex cyber crime networks that impact consumers worldwide.

Finally, the report highlights how service providers can lead the fight against scams through proactive fraud prevention, cyber security training, and ongoing consumer education. By embedding protection into everyday services, they can shift from reactivity to resilience. The conclusion is clear: tackling scams requires addressing both the technical and human elements of cyber fraud—strengthening empathy, awareness, and trust.

Download the Report

Explore comprehensive consumer data and scam insights in the F‑Secure Scam Intelligence & Impacts Report 2025.

Dive Deeper into the Insights

2025 Scam Landscape: How Overconfidence Leaves Consumers Vulnerable

Scams don’t just exploit gaps in knowledge—they prey on overconfidence. Based on new market survey findings and scam statistics, this chapter unpacks the paradox of modern cyber crime: the more confident consumers feel, the more vulnerable they become.

By Timo Salmi

Senior Solution Marketing Manager, F‑Secure

Humanizing Scams: “How Could You Be So Stupid?”—A Victim’s Story

Why do people fall for scams? In this chapter, Tracy Hall recounts being the final victim of con man Hamish McLaren—revealing how he manipulated her trust through scam psychology and underscoring the need to put people at the center of scam prevention and recovery.

Tracy Hall

Author, Speaker, and Advocate

The AI Scam Boom: 4 Ways Scammers Are Using Artificial Intelligence in 2025

AI is fueling a new wave of scams, helping threat actors scale faster and appear more convincing. This chapter breaks down AI security threats and explores the human cost of these increasingly sophisticated attacks.

Dr Megan Squire

Threat Intelligence Researcher, F‑Secure

The Silent Toll of Scams: Breaking the Cycle of Shame and Inaction

Drawing on cyber fraud statistics from the Global Anti-Scam Alliance (GASA), this chapter explores the deeper human toll of scams—from victim shaming to silence driven by stigma—and why awareness alone isn’t enough.

Jorij Abraham

Managing Director, Global Anti-Scam Alliance

Risk vs Reality: Crypto Feels Dangerous—But Is Fear Justified?

From crypto hype fueling consumer anxiety to billion-dollar scam networks, this chapter demystifies the cryptocurrency fraud landscape and explores how everyday users can protect themselves in a system built for speed, not safety.

Laura Kankaala

Head of Threat Intelligence, F‑Secure

The Future of Trust: Reckoning with an Increasingly Unreliable Digital World

Grounded in new foresight research, this chapter explores how consumer coping behaviors are evolving in response to an increasingly untrustworthy internet—and how protection must adapt in parallel.

Dr Laura James

Vice President of Research, F‑Secure

Inside Scam Centers: The Dual Realities of Privilege and Exploitation

From designer-clad scam call center employees to trafficked workers forced into scam farms, this chapter exposes the dual realities behind global fraud operations and why service providers must move beyond stereotypes to protect consumers.

Laura Kankaala

Head of Threat Intelligence, F‑Secure

The Future of Scams: What the Next 5 Years Could Bring

Scams are adapting fast—and the next wave could be more personal than ever. This chapter explores what might come next, from AI agents and all-in identity theft to moments of trust that open the door to deception.

Insights from Sarogini Muniyandi, Joel Latto, and Laura Kankaala